Colorado Sales Tax Vendor Fee Elimination 2026: What Colorado Springs Small Businesses Need to Know

Starting January 1, 2026, Colorado will eliminate the 90-year-old sales tax vendor fee that has allowed small businesses to keep up to 4% of collected state sales taxes (capped at $1,000 monthly) as compensation for their collection efforts. This change, enacted through House Bill HB25B-1005 during the 2025 special legislative session, will impact thousands of Colorado Springs small businesses who currently rely on this rebate to offset administrative costs. As your trusted Colorado Springs CPAs, we'll help you understand exactly how this elimination affects your bottom line and what steps you need to take before the deadline.

Critical Date Alert

Understanding the Colorado Sales Tax Vendor Fee: What's Being Eliminated

The sales tax vendor fee, also known as the service fee or vendor allowance, has been part of Colorado's tax system since the 1930s. This rebate was designed to compensate retailers for the costs associated with calculating, collecting, and remitting sales taxes to the state—essentially paying businesses for acting as unpaid tax collectors.

Current Vendor Fee Structure (Through December 31, 2025)

Under the current system, qualifying Colorado businesses can retain:

- 4% of collected state sales tax when filed timely

- Maximum $1,000 per filing period (typically monthly)

- Up to $12,000 annually for businesses filing monthly

- Only for businesses with less than $1 million in taxable sales per filing period

Calculate Your Lost Revenue

A Colorado Springs retailer with $500,000 in annual taxable sales currently keeps approximately $48 per month ($580 annually) through the vendor fee. Starting in 2026, this entire amount becomes an additional business expense.

Why Colorado Eliminated the Sales Tax Vendor Fee

During the August 21-26, 2025 special legislative session, Colorado lawmakers voted to eliminate the vendor fee to help address a projected budget shortfall. The elimination is expected to generate approximately $56.8 million in additional state revenue for the 2026-2027 fiscal year.

Legislative Rationale

Proponents of the elimination argued that:

- Modern accounting software and automation have reduced the burden of sales tax collection

- The state needs additional revenue to balance the budget without raising taxes

- Many large retailers already don't qualify due to the $1 million cap implemented in 2022

Small Business Opposition

The National Federation of Independent Business (NFIB) and many Colorado Springs small business owners strongly opposed the elimination, arguing that it:

- Turns small business owners into "unpaid tax collectors"

- Ignores ongoing administrative costs of compliance

- Disproportionately impacts smaller retailers who can least afford the loss

- Adds another financial burden during challenging economic times

Colorado Springs Business Impact

Timeline: Key Dates for Colorado Springs Businesses

| Date | Action Required | Impact on Your Business |

|---|---|---|

| Now - December 31, 2025 | Continue claiming vendor fee on all eligible returns | Maximize remaining rebate opportunity |

| January 1, 2026 | Vendor fee elimination takes effect | No vendor fee available for sales made January 2026 forward |

| January 20, 2026 | Last return with vendor fee (December 2025 sales) | December 2025 sales can still claim vendor fee if filed timely |

| February 20, 2026 | First return for 2026 sales (January) | No vendor fee available - full tax remittance required |

Financial Impact Analysis: What This Means for Your Bottom Line

The vendor fee elimination creates a direct hit to small business profitability. Here's how different Colorado Springs business types will be affected:

Retail Stores

Retail Impact Checklist

Restaurants and Food Service

Colorado Springs restaurants face unique challenges as they typically have:

- Higher transaction volumes with lower average tickets

- Complex tax calculations for different product types

- Multiple transaction types requiring consistent tax application

- Loss of vendor fee benefits that vary based on monthly sales volume

Service Businesses

Service providers (salons, repair shops, contractors) collecting sales tax will lose vendor fee benefits on:

- Taxable services and labor

- Parts and materials sales

- Digital goods and software subscriptions

Professional Services Exemption

Action Steps: Preparing Your Business for 2026

Immediate Actions (Before December 31, 2025)

- Audit Your Current Vendor Fee Claims

- Review past returns to ensure you're claiming the maximum allowable vendor fee

- File any amended returns if you've missed vendor fee deductions

- Ensure your accounting software is properly calculating the 4% (up to $1,000)

- Accelerate December 2025 Filing

- File your December 2025 return by the January 20, 2026 deadline

- This is your last opportunity to claim the vendor fee

- Don't miss this final rebate by filing late

- Update Your 2026 Budget

- Add vendor fee loss as a new expense line item

- Calculate monthly and annual impact based on your sales volume

- Consider price adjustments if margins are tight

Strategic Tax Planning Opportunity

Long-term Adjustments for 2026 and Beyond

- Evaluate Sales Tax Automation Software

Since you're no longer compensated for manual tax calculations, investing in automation becomes more critical:

- Compare costs of Avalara, TaxJar, or Vertex solutions

- Look for integration with your existing POS or accounting system

- Calculate ROI based on time savings versus vendor fee loss

- Review Pricing Strategy

Consider whether to absorb the vendor fee loss or adjust pricing:

- Calculate the percentage increase needed to maintain margins

- Analyze competitor pricing and market conditions

- Communicate transparently with customers about state-mandated changes

- Optimize Other Tax Deductions

Work with your CPA to maximize remaining deductions:

- Qualified Business Income (QBI) deduction optimization

- Strategic equipment purchases under Section 179

- R&D tax credits for qualifying activities

- Work opportunity tax credits for hiring from targeted groups

Special Considerations for Multi-Jurisdictional Businesses

State vs. Local Vendor Fees

The elimination only affects the state sales tax vendor fee. Colorado's home-rule cities may have their own vendor fee policies:

- Colorado Springs: Contact the city's tax division for local vendor fee rules

- Home-rule cities: Each of Colorado's 70+ home-rule municipalities sets independent policies

- State-collected jurisdictions: Follow state rules (no vendor fee after 2026)

Multi-Location Complexity

Businesses operating in multiple Colorado jurisdictions must track different vendor fee rules for each location. Consider centralizing tax compliance with professional help to avoid costly errors.

Common Mistakes to Avoid During the Transition

Vendor Fee Elimination Pitfall Prevention

Legislative Update: Potential Future Changes

While the vendor fee elimination is set for January 1, 2026, the Colorado small business community continues advocating for relief:

- NFIB Colorado continues advocating for small business relief

- Future legislation could potentially restore or modify the vendor fee

- Business associations are working to document the impact on small retailers

Stay informed about potential changes by subscribing to updates from your Colorado Springs CPA and industry associations.

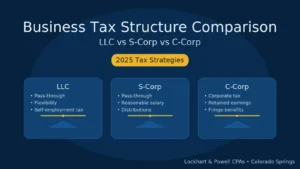

How Lockhart & Powell Can Help Your Business Navigate This Change

The vendor fee elimination is just one of many tax changes affecting Colorado Springs businesses in 2026. As experienced CPAs serving El Paso County for nearly 40 years, we help local businesses:

- Maximize remaining 2025 vendor fee claims through comprehensive return reviews

- Implement tax-saving strategies to offset the vendor fee loss

- Optimize business structure for maximum tax efficiency

- Navigate multi-jurisdictional compliance for businesses operating across Colorado

- Plan strategic purchases and deductions under new tax laws

Free Consultation Offer

Frequently Asked Questions About the Vendor Fee Elimination

Q: Can I still claim the vendor fee for sales made in 2025 but reported in 2026?

A: Yes, if you're reporting December 2025 sales on your January 2026 return (due January 20, 2026), you can still claim the vendor fee as it applies to the period when sales occurred.

Q: Does this affect my local city sales tax vendor fees?

A: No, the elimination only applies to state sales tax. Home-rule cities like Denver, Boulder, and others maintain independent vendor fee policies. Check with each jurisdiction for their specific rules.

Q: What if I've been missing the vendor fee on past returns?

A: You can file amended returns for previous periods within the statute of limitations. Given the upcoming elimination, it's worth reviewing 2023-2025 returns to ensure you've claimed all allowable vendor fees.

Q: Will the vendor fee ever come back?

A: While currently eliminated starting 2026, tax laws can change. The small business community continues advocating for restoration. Stay informed through your CPA and industry associations.

Q: How do other states handle vendor compensation?

A: Many states offer vendor compensation with varying structures: Alabama (5% on first $100, 2% after, capped at $400/month), Georgia (3% up to $3,000, then 0.5%), Kentucky (1.75% of first $1,000, then 1.5%, capped at $50). Colorado joins states like California and Oregon that don't compensate sales tax collection.

Conclusion: Adapting to the New Sales Tax Landscape

The elimination of Colorado's sales tax vendor fee represents a significant change for small businesses across Colorado Springs and El Paso County. While the loss of up to $12,000 annually in vendor fee rebates will impact your bottom line, proper planning and strategic tax optimization can help offset these costs.

The key is taking action now—before the December 31, 2025 deadline—to ensure you're maximizing current vendor fee claims while preparing for the new reality of 2026. By working with an experienced Colorado Springs CPA, you can navigate this transition while identifying alternative tax savings opportunities to maintain your business's financial health.

Final Strategic Reminder

Lockhart & Powell CPAs has served Colorado Springs businesses for nearly 40 years, providing strategic tax planning, compliance, and advisory services. Our team stays current on all Colorado tax law changes to ensure our clients maximize every available deduction and credit. Contact us at (719) 578-8200 or visit our Colorado Springs office to discuss how we can help your business thrive despite the vendor fee elimination.