Do I Need a CPA for My Small Business? 10 Signs Colorado Springs Entrepreneurs Should Hire a Professional

Every Colorado Springs small business owner eventually asks the same question: "Do I really need a CPA, or can I keep doing my own taxes?" With accounting software like QuickBooks and tax programs like TurboTax promising to simplify everything, it's tempting to handle finances yourself—especially when you're watching every dollar. But the honest answer is more nuanced than you might expect. While some businesses can successfully manage DIY accounting in their early stages, most reach a point where professional guidance doesn't just save time—it saves thousands of dollars and prevents costly mistakes that can haunt your business for years.

As Colorado Springs CPAs who've served El Paso County businesses for nearly 40 years, we've seen the patterns clearly: entrepreneurs who transition from DIY to professional accounting at the right time consistently outperform those who wait too long. More importantly, we've also witnessed the expensive consequences when businesses delay hiring a CPA—missed deductions totaling tens of thousands, entity structure mistakes that cost 15.3% in unnecessary self-employment taxes, and IRS audits triggered by preventable errors.

This comprehensive guide will help you honestly assess whether you've reached the point where hiring a CPA transforms from an expense into one of your best investments.

Quick Self-Assessment

Understanding the True Cost Question: CPA Fees vs. DIY Savings

Before diving into the "should I hire?" question, let's address the elephant in the room: cost. Many Colorado Springs business owners delay hiring a CPA because they're comparing a visible expense (professional fees) against an invisible benefit (tax savings, time reclaimed, mistakes avoided).

What CPAs Actually Cost in Colorado Springs (2025)

Understanding typical CPA costs helps you make an informed decision:

| Service Type | Typical Cost Range | What's Included |

|---|---|---|

| Basic Tax Return Only | $500 - $1,200 | Annual business return preparation (Schedule C, 1120-S, 1065, or 1120) |

| Tax Return + Consultation | $1,200 - $2,500 | Return preparation plus quarterly check-ins and basic tax planning |

| Full-Service Package | $2,500 - $5,000+ | Returns, strategic planning, entity optimization, audit support, year-round advice |

| Monthly Bookkeeping | $300 - $800/month | Transaction categorization, reconciliation, financial statements |

| Hourly Consulting | $200 - $400/hour | Specific questions, strategic planning, special projects |

The Hidden Costs of DIY

What business owners often overlook are the costs of not hiring a CPA:

- Missed Deductions: The average small business leaves $5,000-$15,000 in legitimate deductions unclaimed annually

- Wrong Entity Structure: Operating as a sole proprietor when you should be an S-Corp can cost 15.3% in unnecessary self-employment taxes—$9,180 on $60,000 income

- Time Opportunity Cost: If you spend 15 hours monthly on accounting tasks at a $100/hour opportunity cost, that's $18,000 annually

- IRS Penalties: Late filing, incorrect calculations, or missed estimated payments trigger penalties averaging $1,500-$5,000

- Audit Risk: DIY returns have higher audit rates, and representation during an audit costs $5,000-$15,000 if you don't have an existing CPA relationship

The Break-Even Reality

10 Clear Signs You Need to Hire a CPA

Here are the definitive indicators that your Colorado Springs business has reached the professional CPA threshold:

1. Your Net Business Income Exceeds $60,000

This is the most important revenue threshold in small business taxation. Once your business nets $60,000 or more annually, the tax optimization opportunities available through proper entity structure, strategic deductions, and professional planning typically exceed CPA fees by a factor of 3-5.

Why $60,000 matters:

- S-Corp Election Becomes Valuable: At this income level, converting to S-Corporation status can save $9,000+ annually in self-employment taxes

- QBI Deduction Optimization: The 20% Qualified Business Income deduction has complex limitations at higher incomes—professional guidance maximizes this benefit

- Equipment Expensing Strategy: Section 179 and bonus depreciation decisions require analysis of current vs. future year income

- Estimated Tax Management: Higher income means larger quarterly payments where miscalculation triggers penalties

Real Example: Colorado Springs Consultant

Sarah runs a marketing consulting business as a sole proprietor with $80,000 net income. She pays $12,240 in self-employment tax (15.3%). Her CPA recommends S-Corp election with a $45,000 salary and $35,000 distribution. New self-employment tax: $6,885. Annual savings: $5,355. CPA annual fee: $2,000. Net benefit: $3,355 in year one, plus ongoing savings every year.

2. You're Spending 10+ Hours Monthly on Financial Tasks

Time is your most valuable resource as a business owner. If you're spending more than 10 hours monthly on bookkeeping, tax research, expense categorization, and financial statement preparation, you've crossed into inefficient territory.

Calculate your opportunity cost:

- 15 hours monthly × 12 months = 180 hours annually

- 180 hours × $100/hour billable rate = $18,000 opportunity cost

- Even at a conservative $50/hour value, that's $9,000 annually

A CPA plus bookkeeper costs $3,000-$5,000 annually for a small business—freeing up 150+ hours you can spend generating revenue, developing products, or serving clients.

3. You've Hired Your First Employee

Hiring employees introduces a complexity level that catches most business owners off-guard. Payroll isn't just about cutting checks—it involves tax withholding calculations, quarterly Form 941 filings, annual W-2 preparation, unemployment insurance, workers' compensation considerations, and strict compliance deadlines.

Colorado-specific payroll considerations:

- Colorado State Withholding: 4.25% flat rate on all wages

- Colorado Family Medical Leave Insurance (FAMLI): Premium split between employer and employee starting 2025

- Local Occupational Privilege Taxes: Some Colorado municipalities require additional withholding

- Paid Sick Leave Requirements: Colorado requires accrual tracking and proper payment

Payroll Penalty Reality

4. You're Considering or Have Changed Entity Structure

Entity structure decisions—sole proprietorship, LLC, S-Corporation, C-Corporation, or partnership—have profound, long-lasting tax implications. Making this choice without professional guidance often leads to costly mistakes that take years and thousands of dollars to correct.

Common entity structure questions requiring CPA expertise:

- Should I elect S-Corp status for my LLC?

- Would C-Corp status help me qualify for QSBS (Qualified Small Business Stock) benefits?

- How do I determine "reasonable compensation" for S-Corp owners?

- Should I use Colorado's PTET (pass-through entity tax) election?

- What's the tax impact of bringing on a business partner?

Entity Structure Red Flags

5. You Operate in Multiple States or Have Out-of-State Clients

Multi-state operations create tax complexity that multiplies quickly. Colorado-based businesses with customers, employees, inventory, or offices in other states face nexus questions, state tax filing obligations, and apportionment calculations that are nearly impossible to navigate without professional help.

Multi-state trigger events:

- Economic Nexus: Exceeding state-specific revenue thresholds ($100,000 in most states) creates sales tax obligations

- Remote Employees: Hiring someone who works from another state triggers withholding and potentially income tax filing

- Inventory Storage: Using Amazon FBA or third-party warehouses creates physical presence

- Trade Shows: Extended presence in another state can create temporary filing obligations

- Partnership Income: Multi-state partnerships require composite returns or member-level filings

Colorado Springs businesses with Wyoming customers, New Mexico operations, or Kansas employees need CPA guidance to avoid underpayment penalties and compliance issues.

6. You're Uncertain About Deductions You Can Claim

Tax law contains hundreds of legitimate business deductions—but also dozens of commonly misunderstood ones that trigger audits. If you're regularly questioning whether expenses are deductible, you're likely both overclaiming some items and missing others.

Commonly missed deductions Colorado Springs CPAs identify:

- Home Office Deduction: Many business owners either claim it incorrectly or avoid it entirely due to audit fears

- Vehicle Expenses: Choosing between standard mileage and actual expense method requires analysis

- Startup Costs: $5,000 immediate deduction plus amortization rules are frequently misapplied

- Section 179 & Bonus Depreciation: Equipment expensing strategy affects multi-year tax planning

- Retirement Contributions: SEP IRA, Solo 401(k), and SIMPLE IRA contribution limits and deadlines vary

- Health Insurance: Self-employed health insurance deduction has specific requirements

- Qualified Business Income (QBI) Deduction: 20% deduction with complex phase-out rules

- Research & Development: Many businesses conduct qualifying R&D without realizing it

The Deduction Audit

7. You've Purchased or Are Planning to Purchase Real Estate or Major Equipment

Capital asset purchases—vehicles, equipment, machinery, buildings, or real estate—involve depreciation rules that significantly impact your tax liability across multiple years. The timing and structure of these purchases requires strategic planning.

Why major purchases need CPA input:

- Section 179 Limitations: Up to $2.5 million immediate expensing for 2025-2026, but only up to business income

- Bonus Depreciation Strategy: 100% bonus depreciation can create losses, but should you take it?

- Listed Property Rules: Vehicles and equipment have special documentation requirements

- Purchase vs. Lease Analysis: Tax implications differ substantially between purchasing and leasing

- Real Estate Cost Segregation: Accelerates depreciation on commercial property but requires professional study

Common costly mistake: Purchasing $100,000 in equipment in December and taking full bonus depreciation, only to realize in March that you didn't have enough income from other sources to benefit—and now you can't go back and spread the deduction across multiple years.

8. Your Business is Growing Rapidly or You're Planning Expansion

Business growth is exciting—but rapid revenue increases trigger tax implications that catch unprepared owners by surprise. If your revenue is growing 30%+ annually, you need proactive tax planning to avoid a shocking April 15 tax bill.

Growth-related planning opportunities:

- Quarterly Estimated Tax Adjustments: Underpayment penalties hit fast-growing businesses hard

- Entity Structure Reevaluation: The optimal structure at $50,000 income differs from $200,000

- Retirement Plan Contributions: High-profit years are perfect for maximizing tax-deferred savings

- Equipment Purchase Timing: Strategic year-end purchases reduce tax on windfall profits

- Multi-Year Income Smoothing: Techniques to avoid bunching income into high-tax years

Growth Planning Strategy

9. You've Received an IRS Notice or Fear an Audit

IRS notices range from simple discrepancy letters to full-blown audit notifications. Either way, having professional representation is invaluable—and attempting to handle it yourself often makes situations worse.

Why CPAs matter during IRS interactions:

- Professional Representation: CPAs have Power of Attorney to speak directly with the IRS on your behalf

- Response Strategy: Knowing what to send, what to explain, and what to avoid disclosing

- Audit Experience: Understanding what IRS agents look for and how to present documentation

- Negotiation Authority: CPAs can negotiate payment plans, penalty abatement, and offer in compromise

- Emotional Buffer: Removing the stress of direct IRS communication

Common IRS notices Colorado Springs businesses receive:

- CP2000: Income discrepancy (1099 doesn't match tax return)

- CP14: Balance due notice

- CP501/503: Overdue tax bill with increasing urgency

- Letter 525: General audit notification

- Letter 566: Office audit appointment

Audit Representation Reality

10. You Want to Sell Your Business or Bring on Partners/Investors

Exit planning, partnership changes, and investment raises involve complex tax implications that can make or break the financial success of these transactions. Professional guidance isn't optional—it's essential.

Transaction-related CPA services:

- Business Valuation: Understanding fair market value for tax and negotiation purposes

- Deal Structure Optimization: Asset sale vs. stock sale has vastly different tax consequences

- Partnership Agreement Review: Tax implications of profit splits, capital contributions, and distributions

- QSBS Planning: Qualifying for up to $15 million in tax-free capital gains

- Installment Sale Structuring: Spreading tax liability across multiple years

- Due Diligence Support: Clean financials and tax compliance verification

Colorado Springs business owners planning to sell within 2-3 years should engage a CPA immediately—many tax-saving strategies require advance planning that can't be implemented after a letter of intent is signed.

The DIY Zone: When You Might Not Need a CPA (Yet)

To provide balanced guidance, here are situations where DIY accounting might still be appropriate:

DIY May Still Work If...

However, even businesses in the "DIY zone" benefit from at least an annual CPA consultation to review your work, identify missed opportunities, and confirm you're on the right track.

CPA vs. Bookkeeper vs. Tax Preparer: Understanding the Differences

Not all financial professionals offer the same services. Understanding the distinctions helps you hire the right expertise:

| Professional | Education/Credentials | Primary Services | Best For |

|---|---|---|---|

| CPA (Certified Public Accountant) | Bachelor's degree, 150 credit hours, pass rigorous exam, ongoing CPE requirements | Tax planning, strategic advice, audit representation, complex returns, entity structure guidance | Businesses needing strategic guidance, complex situations, audit protection |

| Enrolled Agent | Pass IRS exam or former IRS employee, ongoing CPE requirements | Tax preparation, IRS representation, tax planning | Complex tax situations, IRS issues, alternative to CPA for tax-focused needs |

| Bookkeeper | No formal requirements (certification optional) | Transaction recording, bank reconciliation, financial statements | Day-to-day financial tracking, ongoing monthly support |

| Tax Preparer | Minimal federal requirements, varies by state | Basic tax return preparation | Simple returns, limited strategic planning |

Optimal setup for most Colorado Springs businesses: Bookkeeper for monthly transaction processing + CPA for strategic planning, tax preparation, and advisory services.

What to Look for in a Colorado Springs CPA

Not all CPAs are created equal. When evaluating potential accounting partners for your Colorado Springs business, consider these factors:

Essential Qualifications

- Colorado License: Verify active CPA license through the Colorado State Board of Accountancy

- Small Business Experience: Look for firms specializing in small business, not large corporate or individual-only practices

- Industry Knowledge: Experience with your industry's specific tax issues (construction, restaurants, professional services, etc.)

- Multi-State Competency: If you operate beyond Colorado, ensure they handle multi-state returns

- Tax Software & Systems: Modern, secure systems for document sharing and communication

Service Approach Red Flags

Warning Signs to Avoid

Questions to Ask During Consultation

- "How many Colorado Springs small businesses do you work with in my industry?"

- "What's included in your annual fee, and what costs extra?"

- "Will I work with you directly or be handed off to junior staff?"

- "How do you handle urgent questions during the year?"

- "Can you provide references from similar businesses?"

- "What's your approach to proactive tax planning vs. reactive return preparation?"

- "Do you provide audit defense and IRS representation?"

- "How do you stay current on Colorado-specific tax law changes?"

Understanding the ROI: Common Tax Savings Scenarios

Still questioning whether a CPA is worth the investment? Here are common scenarios that illustrate typical tax savings opportunities for Colorado Springs businesses:

Scenario: Retail Shop Owner

Situation: Boutique owner with $120,000 net income, filing as sole proprietor, paying $18,360 in self-employment tax annually.

Potential CPA Solution: S-Corp election with $60,000 reasonable salary. Self-employment tax reduced to $9,180. Annual savings: $9,180. Typical CPA fee: $2,200. Net benefit: $6,980 year one, plus ongoing savings every year thereafter.

Scenario: Contractor

Situation: HVAC contractor purchasing $85,000 in work vehicles and equipment, unsure about depreciation strategy.

Potential CPA Solution: Strategic mix of Section 179 ($50,000 immediate) and 5-year depreciation ($35,000 spread) to optimize current-year deduction without creating unusable loss. Potential tax savings: $18,700. Planning fee: $800. Net benefit: $17,900.

Scenario: Software Consultant

Situation: Solo consultant with $90,000 income who missed QBI deduction entirely and claimed questionable home office deduction incorrectly.

Potential CPA Solution: Properly calculated $18,000 QBI deduction, corrected home office to simplified method. Filed amended return for prior year. Potential recovery: $24,000 (2 years). Typical CPA fee: $1,800. Net benefit: $22,200.

How to Transition from DIY to Professional CPA Services

Ready to make the transition? Here's how to ensure a smooth handoff from DIY to professional management:

Step 1: Gather Your Financial Information

- Prior year tax returns (3 years if available)

- Current year income and expense records

- Bank and credit card statements

- Loan documents and debt schedules

- Payroll records (if applicable)

- Business formation documents (articles of incorporation, operating agreement, etc.)

- Previous correspondence with IRS or state tax agencies

Step 2: Schedule Consultations with 2-3 CPAs

Most Colorado Springs CPAs offer free initial consultations. Interview multiple firms to find the best fit for your business personality, communication style, and service needs.

Step 3: Be Honest About Your Situation

Don't hide problems or mistakes from your prospective CPA. They've seen it all, and honesty upfront allows them to provide accurate guidance and avoid surprises during tax preparation.

Step 4: Set Clear Expectations

Discuss:

- Response time expectations for questions

- Meeting frequency (quarterly recommended for most businesses)

- Preferred communication methods (email, phone, portal)

- Document sharing procedures

- Fee structure and payment terms

Step 5: Establish Year-Round Communication

The biggest mistake new clients make is treating their CPA like a once-a-year tax preparer. Maximum value comes from year-round communication—notify your CPA before major decisions, ask questions when they arise, and schedule quarterly check-ins.

Mid-Year Transition Strategy

Colorado-Specific Tax Considerations Requiring CPA Expertise

Colorado has several unique tax provisions that make local CPA expertise particularly valuable:

Colorado PTET Election (Pass-Through Entity Tax)

Colorado allows S-Corporations and partnerships to elect to pay state income tax at the entity level, creating a federal deduction that bypasses the $10,000 SALT cap limitation. This election can save high-income Colorado Springs business owners $5,000-$15,000+ annually, but requires careful calculation and timely filing.

Colorado Enterprise Zone Credits

Portions of El Paso County qualify for Enterprise Zone tax credits, providing benefits for hiring, equipment purchases, and other business activities. These credits require specific documentation and election procedures.

Colorado Sales Tax Complexity

Colorado's home-rule cities create one of the most complex sales tax environments in the nation. Colorado Springs businesses must navigate state sales tax (2.9%), Colorado Springs city tax (3.07%), and special district taxes—each with different rules, filing frequencies, and reporting requirements.

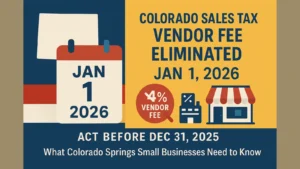

Colorado Vendor Fee Elimination (2026)

Starting January 1, 2026, Colorado eliminated the sales tax vendor fee that previously allowed businesses to keep up to 4% of collected sales tax (capped at $1,000 monthly). This change impacts cash flow and requires budget adjustments for Colorado Springs retailers.

Multi-Jurisdictional Operations

Colorado Springs businesses frequently work with clients or maintain offices in Wyoming, New Mexico, Kansas, or other Colorado cities. Each jurisdiction creates potential tax obligations requiring professional navigation.

Special Considerations for Different Business Types

Restaurants & Hospitality

Colorado Springs restaurants face unique challenges: tip reporting and allocation, sales tax on food vs. beverages, employee meal deductions, liquor license costs, and the new "no tax on tips" provisions. Industry-specific CPA expertise is essential.

Construction & Trades

Contractors deal with heavy equipment depreciation, vehicle expense tracking, job costing, 1099 contractor vs. W-2 employee classification, and progress billing accounting. CPAs with construction experience understand these nuances.

Professional Services

CPAs, attorneys, consultants, and other professionals face QBI deduction phase-outs at higher income levels and must navigate "specified service trade or business" limitations. Professional service CPAs specialize in these constraints.

E-Commerce & Online Businesses

Online sellers must track sales tax nexus in multiple states, understand marketplace facilitator rules, classify digital product taxation, and document home office deductions. E-commerce accounting requires specialized knowledge.

Real Estate Investors

Rental property owners benefit from cost segregation studies, short-term rental tax classifications, passive activity loss limitations, and 1031 exchange opportunities—all requiring professional guidance.

Common Mistakes Business Owners Make Without CPA Guidance

Costly DIY Tax Mistakes We See Regularly

The Bottom Line: When Does a CPA Pay for Themselves?

Here's the straightforward framework for deciding whether you need a CPA for your Colorado Springs small business:

You Definitely Need a CPA If:

- ✅ Your net business income exceeds $60,000

- ✅ You have employees

- ✅ You operate in multiple states

- ✅ You're considering entity structure changes

- ✅ You received an IRS notice

- ✅ You're planning to sell your business

- ✅ You spend 10+ hours monthly on financial tasks

You Probably Need a CPA If:

- ⚠️ Your net income is $30,000-$60,000 and growing

- ⚠️ You're uncertain about deductions you're claiming

- ⚠️ You purchased or plan to purchase major equipment or real estate

- ⚠️ Your business is growing 30%+ annually

- ⚠️ You have complex income sources (rental property, investments, multiple businesses)

DIY Might Still Work If:

- ✓ Your net income is under $30,000

- ✓ You're a simple sole proprietor with straightforward expenses

- ✓ You have no employees

- ✓ You operate only in Colorado

- ✓ You're comfortable with tax research and have time to dedicate

But remember: Even businesses in the "DIY might work" category benefit from at least an annual CPA review to catch missed opportunities and confirm compliance.

Get Your Free CPA Needs Assessment

Not sure if you're at the threshold where a CPA makes financial sense? Lockhart & Powell CPAs offers a complimentary 45-minute consultation to assess your specific situation, identify potential tax savings, and provide honest guidance about whether professional services would benefit your Colorado Springs business. No pressure, just straight talk from CPAs who've served El Paso County for nearly 40 years.

Schedule Your ConsultationFrequently Asked Questions

Q: Can I switch CPAs if I'm unhappy with my current one?

A: Absolutely. You can change CPAs at any time, though switching mid-year or during tax season may complicate the current year's return. The best time to transition is immediately after filing your current year return, giving your new CPA a full year to work with you. Simply request that your old CPA provide copies of your prior returns and working papers.

Q: What's the difference between a CPA and someone who just prepares taxes?

A: CPAs have extensive education requirements (150 credit hours), pass a rigorous national exam, and maintain ongoing continuing education. They can provide audit representation, strategic tax planning, and advisory services beyond basic return preparation. Non-CPA tax preparers may have minimal credentials and typically only prepare returns without strategic planning.

Q: How often should I communicate with my CPA?

A: At minimum, quarterly check-ins are recommended for most businesses. Additionally, contact your CPA before major decisions (equipment purchases, hiring employees, entity changes, large contracts, etc.). The more your CPA knows about your business activities, the better they can provide proactive guidance.

Q: Will a CPA really save me more than they cost?

A: For businesses netting $60,000+, yes—typically by a factor of 3-5 times their fee in the first year, and ongoing savings every year thereafter. The combination of tax reduction strategies, deduction optimization, entity structure improvements, and mistake prevention usually exceeds CPA fees substantially.

Q: What if I can't afford a CPA right now?

A: Consider at least a one-time consultation ($300-$500) where a CPA reviews your situation and provides guidance you can implement yourself. Many CPAs also offer payment plans or scaled service packages for growing businesses. Remember that the cost of NOT having proper guidance often exceeds the cost of the CPA.

Q: Do I need both a bookkeeper and a CPA?

A: For most businesses, the optimal setup is: bookkeeper for monthly transaction processing and reconciliation + CPA for strategic planning, tax preparation, and advisory services. This combination provides comprehensive financial management at a reasonable cost. Very small businesses might only need a CPA who can handle both roles.

Q: What happens if my CPA makes a mistake on my return?

A: Professional CPAs carry errors and omissions insurance and will correct mistakes at no charge. You remain ultimately responsible for your tax return, but CPAs provide protection through their professional standards, insurance, and expertise. Always verify your CPA carries professional liability insurance.

Q: Can a CPA help if I'm behind on taxes or haven't filed in years?

A: Yes. CPAs regularly help business owners get caught up on unfiled returns, negotiate payment plans with the IRS, and request penalty abatement. The sooner you address the situation with professional help, the better the outcome. Don't let fear of judgment prevent you from getting help—CPAs have seen it all and are there to help, not judge.

Taking the Next Step: Moving from DIY to Professional CPA Partnership

The transition from DIY accounting to professional CPA services represents a significant milestone in your business growth. It's not an admission that you can't handle your finances—it's a strategic decision to leverage specialized expertise so you can focus on what you do best: running and growing your business.

The business owners who thrive aren't necessarily those who know everything about tax law—they're the ones who recognize when specialist expertise provides better ROI than attempting to do everything themselves. Time spent researching tax deductions or worrying about IRS compliance is time not spent serving clients, developing products, or scaling operations.

For Colorado Springs businesses, local CPA expertise provides additional value through deep knowledge of Colorado-specific tax provisions, El Paso County business considerations, and the unique challenges facing businesses in our market. National tax preparation chains can prepare your return, but they won't understand Colorado's PTET election, Enterprise Zone credits, or the sales tax complexity of multi-jurisdictional operations.

In nearly 40 years serving Colorado Springs businesses, I've never seen a business owner regret hiring a CPA—only regret waiting too long to make the move. The most successful business owners we work with view their CPA as a strategic partner, not just a tax preparer. That mindset shift makes all the difference in building long-term business success.

Ready to Explore Whether a CPA is Right for Your Business?

If you've made it this far through this guide, you're probably past the point where DIY makes sense for your Colorado Springs business. The question isn't whether professional guidance would help—it's whether the timing is right and whether you've found the right CPA partner.

Lockhart & Powell CPAs has served Colorado Springs and El Paso County businesses for nearly 40 years, providing strategic tax planning, entity optimization, compliance support, and year-round advisory services to businesses from sole proprietors to established corporations. We specialize in small business taxation and understand the unique challenges facing Colorado entrepreneurs.

What You Can Expect from Your Free Consultation:

- Honest Assessment: We'll tell you whether you truly need a CPA or if you're fine continuing DIY for now

- Opportunity Analysis: Identification of potential tax savings based on your current situation

- Entity Structure Review: Evaluation of whether your current business structure is optimal

- Deduction Audit: Review of commonly missed deductions relevant to your industry

- Service Recommendations: Clear explanation of which services would benefit your business

- Transparent Pricing: Upfront fee structure with no surprises

Schedule Your Free Consultation Today

About Lockhart & Powell CPAs: For nearly four decades, we've helped Colorado Springs businesses navigate complex tax laws, optimize entity structures, and maximize profitability through strategic financial planning. Our deep understanding of both federal tax code and Colorado-specific opportunities ensures our clients never pay more tax than legally required. From Main Street small businesses to growing enterprises, we're your trusted partner in building sustainable business success. Located in Colorado Springs, we serve businesses throughout El Paso County and the Pikes Peak region.